Nvidia's Woes Cast a Shadow Over Wall Street's Cautious Start

Amid geopolitical tensions and economic uncertainty, Nvidia succumbs to regulatory challenges, impacting tech sector performance.

In the wake of a recent rally, Wall Street enters the week on a note of consolidation, weighed down by apprehensions surrounding inflation data poised to steer the Federal Reserve's forthcoming rate decision on December 18.

Market expectations strongly tip towards a 25-basis-point rate cut, reflecting a nuanced sentiment shift since last Friday.

The Dow Jones Index, S&P 500, and Nasdaq Composite each retreated by approximately 0.5% to 0.6%, mirroring broader cautiousness.

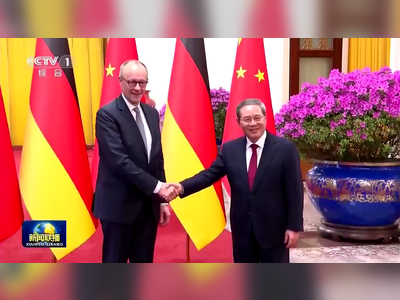

This hesitancy is magnified by looming weaknesses from China, where consumer price trends suggest subdued demand in the world's second-largest economy.

Despite intentions for proactive fiscal policies and moderately loose monetary strategies by China’s ruling Politburo, tangible bullish impetus on stock markets remains elusive.

Geopolitical complexities further compound investor vigilance.

The recent fall of Syria’s regime under Bashar al-Assad introduces a fresh layer of uncertainty in the Middle East, affecting global oil prices, bolstered by the indirect involvement of oil powerhouses Russia and Iran.

Consequently, Brent and WTI prices surged by up to 1.4%.

On the domestic front, Treasury yields saw a slight uptick as President-elect Donald Trump confirmed his support for Federal Reserve Chairman Jerome Powell, suggesting continuity in the Fed's inflation combat strategy.

In light of Trump’s protectionist policies, this may foreseeably lead to higher interest rates if inflation pressures persist.

The Dollar, rebounding from minor downturns, gained marginally, indicating market underestimation of a potential halt in Fed’s rate cuts.

With a mere 10% probability placed on rate maintenance, upcoming U.S. inflation data could underscore this perspective if disinflation remains stuck.

In the realm of commodities, gold prices rose by 1.0% as geopolitical turmoil and anticipated interest rate cuts create a fertile ground for the metal’s appeal.

Reports also suggest renewed purchasing activity by the Chinese central bank after a half-year pause.

Nvidia bore the brunt of tech sector's decline, dropping 2.5% amidst reports of a Chinese antitrust investigation into alleged regulatory non-compliance.

This downturn was echoed in telecommunications, with T-Mobile US and Comcast suffering significant losses due to uninspiring subscriber forecasts, with declines of 6.1% and 9.5%, respectively.

Amidst corporate maneuvers, Mondelez International is reportedly eyeing a merger with Hershey, potentially forging a $50 billion food conglomerate.

Meanwhile, Super Micro Computer saw minor gains pending its delayed financial report.

Finally, APOLLO GLOBAL MANAGEMENT and WORKDAY are set to join the S&P 500 on December 23, while AppLovin faced a stark 14.7% drop following its exclusion from the index.

In sum, Wall Street's tentative start not only reflects economic cautiousness ahead of pivotal inflation insights but also underscores the broader implications of geopolitical developments and sector-specific challenges.

Market expectations strongly tip towards a 25-basis-point rate cut, reflecting a nuanced sentiment shift since last Friday.

The Dow Jones Index, S&P 500, and Nasdaq Composite each retreated by approximately 0.5% to 0.6%, mirroring broader cautiousness.

This hesitancy is magnified by looming weaknesses from China, where consumer price trends suggest subdued demand in the world's second-largest economy.

Despite intentions for proactive fiscal policies and moderately loose monetary strategies by China’s ruling Politburo, tangible bullish impetus on stock markets remains elusive.

Geopolitical complexities further compound investor vigilance.

The recent fall of Syria’s regime under Bashar al-Assad introduces a fresh layer of uncertainty in the Middle East, affecting global oil prices, bolstered by the indirect involvement of oil powerhouses Russia and Iran.

Consequently, Brent and WTI prices surged by up to 1.4%.

On the domestic front, Treasury yields saw a slight uptick as President-elect Donald Trump confirmed his support for Federal Reserve Chairman Jerome Powell, suggesting continuity in the Fed's inflation combat strategy.

In light of Trump’s protectionist policies, this may foreseeably lead to higher interest rates if inflation pressures persist.

The Dollar, rebounding from minor downturns, gained marginally, indicating market underestimation of a potential halt in Fed’s rate cuts.

With a mere 10% probability placed on rate maintenance, upcoming U.S. inflation data could underscore this perspective if disinflation remains stuck.

In the realm of commodities, gold prices rose by 1.0% as geopolitical turmoil and anticipated interest rate cuts create a fertile ground for the metal’s appeal.

Reports also suggest renewed purchasing activity by the Chinese central bank after a half-year pause.

Nvidia bore the brunt of tech sector's decline, dropping 2.5% amidst reports of a Chinese antitrust investigation into alleged regulatory non-compliance.

This downturn was echoed in telecommunications, with T-Mobile US and Comcast suffering significant losses due to uninspiring subscriber forecasts, with declines of 6.1% and 9.5%, respectively.

Amidst corporate maneuvers, Mondelez International is reportedly eyeing a merger with Hershey, potentially forging a $50 billion food conglomerate.

Meanwhile, Super Micro Computer saw minor gains pending its delayed financial report.

Finally, APOLLO GLOBAL MANAGEMENT and WORKDAY are set to join the S&P 500 on December 23, while AppLovin faced a stark 14.7% drop following its exclusion from the index.

In sum, Wall Street's tentative start not only reflects economic cautiousness ahead of pivotal inflation insights but also underscores the broader implications of geopolitical developments and sector-specific challenges.

Translation:

Translated by AI

AI Disclaimer: An advanced artificial intelligence (AI) system generated the content of this page on its own. This innovative technology conducts extensive research from a variety of reliable sources, performs rigorous fact-checking and verification, cleans up and balances biased or manipulated content, and presents a minimal factual summary that is just enough yet essential for you to function as an informed and educated citizen. Please keep in mind, however, that this system is an evolving technology, and as a result, the article may contain accidental inaccuracies or errors. We urge you to help us improve our site by reporting any inaccuracies you find using the "Contact Us" link at the bottom of this page. Your helpful feedback helps us improve our system and deliver more precise content. When you find an article of interest here, please look for the full and extensive coverage of this topic in traditional news sources, as they are written by professional journalists that we try to support, not replace. We appreciate your understanding and assistance.